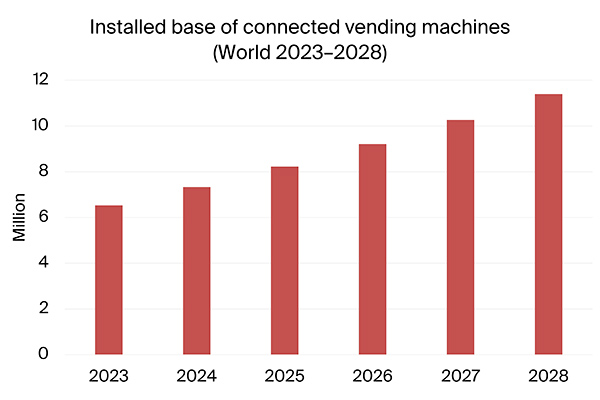

The global installed base of connected vending machines reached an estimated 6.5 million units in 2023 according to a new research report from the IoT analyst firm Berg Insight.

The Rest of the World markets are estimated to represent the largest share of these machines with an installed base of around 2.5 million units. The growth in the Rest of the World markets is primarily driven by the increasing number of connected machines in China and Japan. North America is the second largest market with an estimated installed base of 2.3 million vending machines. The corresponding number for Europe is around 1.8 million.

Berg Insight forecasts that the number of connected vending machines worldwide will grow at a compound annual growth rate (CAGR) of 11.8 percent to reach 11.4 million units by 2028. As a result, the global penetration rate will reach 71.3 percent at the end of the forecast period.

The global connected vending solution market is served by a variety of players. Many of the leading providers are specialised technology companies offering connected vending telemetry and cashless payment solutions.

US-based Cantaloupe is the clear leader in terms of installed base with more than 920,000 connected vending machines, mainly in North America. Other major suppliers include Nayax, Televend (INTIS) and Ingenico. MatiPay, Vendon, InHand Networks and Vianet Group are additional examples of providers with significant installed bases. Numerous vending machine manufacturers are also active in the connected vending space. In this category, Crane Payment Innovations (CPI) holds one of the leading positions from a global perspective, while LE Vending and TCN Group are important players on the growing market in China.

Vending operators active in the field of connected vending machines most often work with third-party providers and some have various in-house solutions. Examples of such vending operators include Chinese UBOX and Italian IVS Group.

The connected vending machine market is currently affected by several trends that are foreseen to impact technology uptake and innovation among the solution vendors. Overall, cashless payments continue to be the main driver for adding connectivity to vending machines.

“Contactless payments, especially those leveraging smartphones, have become ubiquitous for making payments at vending machines in many regions”, said Felix Linderum, IoT Analyst at Berg Insight.

As modern vending equipment such as payment devices and touchscreens increasingly come equipped with integrated connectivity and telemetry functionality, demand for dedicated telemetry devices has been reduced. Comparatively new concepts such as micro markets and Grab-and-Go machines meanwhile continue to re-shape the vending landscape. In particular, the growing adoption of Grab-and-Go machines is expected to have a significant impact on the market.

“Unlike traditional vending machines, Grab-and-Go machines let users grab and return products directly from or to shelves, offering several benefits such as more diverse storage options and the ability to inspect selections before purchase”, continued Mr. Linderum.

These machines are generally connected and incorporate different types of technology such as weight sensors, computer vision and artificial intelligence. The rise of Grab-and-Go machines is particularly evident in China, mainly due to relatively low manufacturing costs. The concept is also gaining traction in Europe and North America.

Mr. Linderum concluded:

“Together with micro markets, Grab-and-Go machines are likely to create new growth opportunities not only for operators but also for providers of vending telemetry and cashless payment solutions.”

The post The global installed base of connected vending machines reached 6.5 million in 2023 appeared first on IoT Business News.