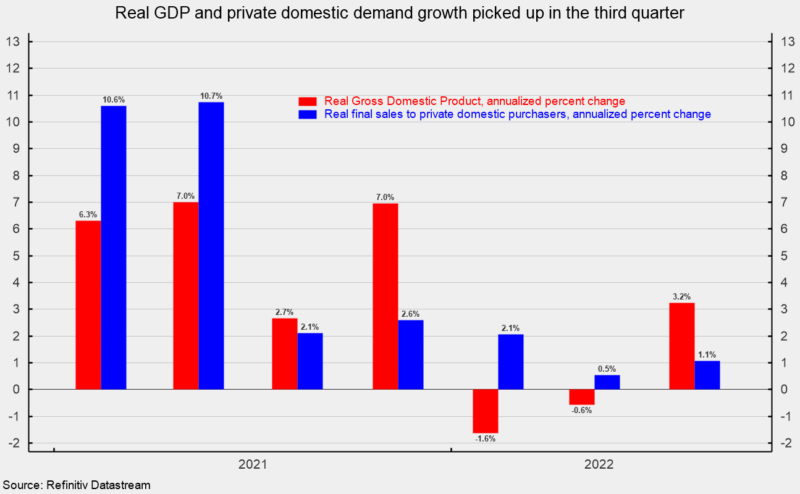

Real gross domestic product rose at a revised 3.2 percent annualized rate in the third quarter versus a 0.6 percent rate of decline in the second quarter and a -1.6 pace in the first quarter (see first chart). Over the past four quarters, real gross domestic product is up 1.9 percent.

Real final sales to private domestic purchasers, about 88 percent of real GDP and a key measure of private domestic demand, has shown greater resilience, with growth having stayed positive despite declines in real GDP. However, growth has slowed significantly, from a 2.6 percent pace in the fourth quarter of 2021 to 2.1 percent in the first quarter, 0.5 percent in the second quarter, and a revised 1.1 percent in the third quarter (see first chart). Over the last four quarters, real final sales to private domestic purchasers are up 1.6 percent.

Headline numbers like GDP don’t provide a complete picture. Despite a solid result for aggregate real GDP growth, performance among the various components of GDP was mixed in the third quarter. Among the components, real consumer spending overall rose at a revised 2.3 percent annualized rate and contributed a total of 1.54 percentage points to real GDP growth. Over the last 40 years, consumer spending has posted average annualized growth of about 3.0 percent and contributed an average of 2.0 percentage points to real GDP growth. Consumer services led the growth in overall consumer spending, posting a 3.7 percent annualized rate, adding 1.63 percentage points to total growth. Consumer services also had significant upward revisions, with notably larger contributions to real GDP growth coming from hospitals, nursing homes, funeral services, live entertainment including sports, portfolio management and investment advisory services, internet services, daycare and nursery school, and commercial and vocational school education.

Durable-goods spending fell at a 0.8 percent pace, the second consecutive decline, subtracting 0.07 percentage points, while nondurable-goods spending fell at a -0.1 percent pace, the third consecutive drop, subtracting 0.01 percentage points (see third and fourth charts).

Business fixed investment increased at a revised 6.2 percent annualized rate in the third quarter of 2022, adding 0.80 percentage points to final growth. Intellectual-property investment rose at a 6.8 percent pace, adding 0.36 points to growth, while business equipment investment rose at a 10.6 percent pace, adding 0.53 percentage points. However, spending on business structures fell at a revised 3.6 percent rate, the sixth decline in a row, subtracting 0.09 percentage points from final growth (see second and third charts).

Residential investment, or housing, plunged at a 27.1 percent annual rate in the third quarter, following a 17.8 annualized fall in the prior quarter. The drop in the third quarter was the sixth consecutive decline and subtracted 1.42 percentage points from third quarter growth (see second and third charts).

Businesses added to inventory at a $38.7 billion annual rate (in real terms) in the third quarter versus accumulation at a $110.2 billion rate in the second quarter. The slower accumulation reduced third-quarter growth by 1.19 percentage points (see third chart). That followed a sizable 1.91 deduction from second quarter real GDP growth that more than accounted for the 0.6 percent decline in total real GDP growth. Swings in inventory accumulation often add significant volatility to headline real GDP growth.

Exports rose at a revised 14.6 percent pace, while imports fell at a revised 7.3 percent rate. Since imports count as a negative in the calculation of gross domestic product, a drop in imports is a positive for GDP growth, adding 1.21 percentage points in the third quarter. The rise in exports added 1.65 percentage points (see second and third charts). Net trade, as used in the calculation of gross domestic product, contributed 2.86 percentage points to overall growth, helping to hide the weakness in domestic demand.

Government spending rose at a revised 3.7 percent annualized rate in the third quarter compared to a 1.6 percent pace of decline in the second quarter, adding 0.65 percentage points to growth.

Consumer price measures showed another rise in the third quarter, though the pace decelerated. The personal-consumption price index rose at a revised 4.3 percent annualized rate, below the 7.3 percent pace in the second quarter and the 7.5 percent rate in the first quarter. From a year ago, the index is up 6.3 percent. However, excluding the volatile food and energy categories, the core PCE (personal consumption expenditures) index rose at a revised 4.7 percent pace matching the second quarter but below the 5.6 percent pace in the first quarter. That is the slowest pace of rise since the first quarter of 2021 (see fourth chart). From a year ago, the core PCE index is up 4.9 percent.

Lingering upward price pressures have resulted in an aggressive Fed policy tightening cycle. The combination of elevated rates of consumer price increases and rising interest rates is impacting consumer and business confidence and weighing on economic activity. The economic outlook remains highly uncertain. Caution is warranted.