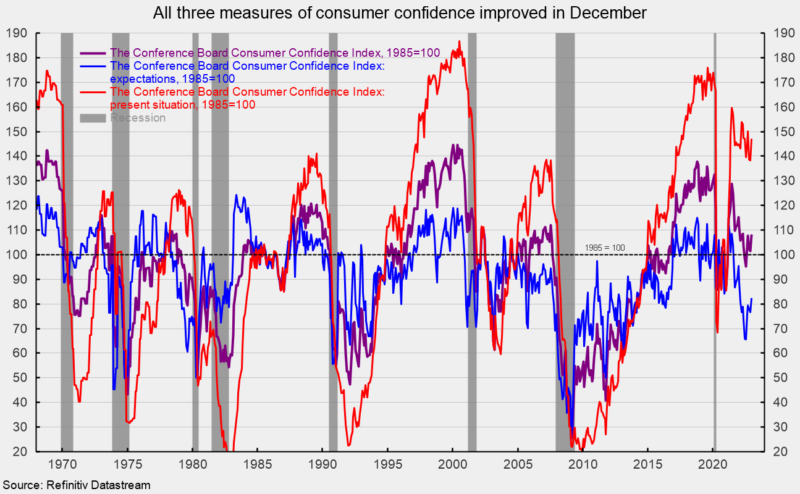

The Consumer Confidence Index from The Conference Board rose in December following two consecutive declines. The composite index increased by 6.9 points, or 6.8 percent, to 108.3 (see first chart). The index is down 6.0 percent from December 2021 and 16.0 percent from the recent peak of 128.9 in June 2021. Both major components of the consumer confidence index improved in December.

The expectations component increased 5.7 points, or 7.4 percent, to 82.4 (see first chart), while the present-situation component – one of AIER’s Roughly Coincident Indicators – gained 8.9 points, or 6.4 percent, to 147.2 (see first chart). The present situation index is up 1.7 percent over the past year while the expectations index is down 13.6 percent from a year ago. The present situation index remains at a historically favorable level while the expectations index remains consistent with prior recessions (see first chart).

Within the expectations index, all three components improved versus November. The index for expectations for higher income fell 0.4 points to 16.7, and the index for expectations for lower income dropped 2.5 points to 13.3, leaving the net (expected higher income – expected lower income) up 2.1 points at 3.4.

The outlook for the jobs market improved in December as the expectations for more jobs index increased by 1.0 point to 19.5, and the expectations for fewer jobs index fell by 2.9 points to 18.3, putting the net up 3.9 points to 1.2.

The index for expectations for better business conditions rose 0.6 points to 20.4, and the index for expected worse conditions fell 0.7 points, leaving the net (expected business conditions better – expected business conditions worse) up 1.3 points at a 0.1 reading.

Current business conditions and current employment conditions improved within the present situation index. The net reading for current business conditions (current business conditions good – current business conditions bad) rose by 4.7 points to -1.1. Current views for the labor market saw the jobs hard to get index drop to 12.0 while the jobs plentiful index rose 2.6 points to a solid 47.8 reading. The net index (jobs hard to get – jobs plentiful) added 4.3 points to 35.8 in December.

According to the report, “The Present Situation and Expectations Indexes improved due to consumers’ more favorable view regarding the economy and jobs.” Furthermore, “Vacation intentions improved but plans to purchase homes and big-ticket appliances cooled further. This shift in consumers’ preference from big-ticket items to services will continue in 2023, as will headwinds from inflation and interest rate hikes.”

The one-year ahead inflation expectations fell 0.4 percentage points to 6.7 percent in December from 7.1 percent in November (see second chart). The drop was largely a function of lower gasoline prices. Notably, the short-term inflation expectations fell farther below the recent peaks of 7.9 percent in March and June 2022. Furthermore, while the pattern of movements between The Conference Board measure and a similar measure from the University of Michigan Survey of Consumers is similar, the overall level from the Michigan survey is much lower; both are moving down from peaks in early 2022. The report notes, “Inflation expectations retreated in December to their lowest level since September 2021, with recent declines in gas prices a major impetus.” Importantly, the longer-term inflation expectations survey from Michigan remains well anchored and consistent with results seen over the last 25 years (see second chart).

Elevated rates of price increases continue to drive an aggressive Fed tightening cycle, sustaining risks for the economic outlook. Weak consumer expectations and fallout from the Russian war in Ukraine further complicate the outlook. Caution is warranted.